Here are some of the amazing (and hard-hitting) questions that Greater NYC for Change members want to ask the candidates for mayor, public advocate and Manhattan borough president.

Questions for the Mayoral Candidates*

*some can be asked of Public Advocate and Borough President candidates

Health care

In New York State, 2.5 million people will soon be eligible for health care coverage under the Affordable Care Act, through Medicaid expansion and exchanges. Enrollment starts Oct. 1st of this year. But those eligible are both young and uniformed: nationally, over half eligible (54%) are under the age of 34, and 78% have no idea what a health care exchange is (according to Enroll America). If elected, how do you plan to educate your constituents about enrolling? What local resources will you commit to making sure the public is aware?

Gun Violence

Do you support the policies enumerated in New York State’s recently passed NY SAFE Act, and what are the tactics as well as long-range strategies you support to reduce gun violence in New York City communities? Are there new ways to look at the old but accelerating problem of urban gun violence?

Homelessness

Forbes estimates that 40,000 people were left homeless by Sandy, adding to the 50,000 already homeless in New York City. Many of the newly homeless were renting apartments that were affordable to them but do not have that opportunity again. How do you plan to address this problem both from a housing perspective but also, specifically, how do you plan to keep track of homeless affected by this crisis to address their needs?

Transportation

Will you continue the fantastic pro-bicycling policies that Bloomberg has initiated and completed throughout the five boroughs?

What are the bike exchange program risks, cost effectiveness, and impact on the city?

Term Limits

In what way did you show respect for the will of the electorate as it related to term limits and why?

Education/Libraries

What should individuals who own private schools in NYC that provide high quality education do when there is an overwhelming phenomenon of charter schools throughout the boroughs forcing private schools to close their doors? Will there be a ceiling or cap on how many more will open?

What do you plan to do about city waste & corruption in the public library systems?

Sandy recovery

The billions in federal aid, administered by Habitat for Humanity International here in New York, are primarily directed at home owners, not renters. There is one program open to renters (and therefore the undocumented), from the American Red Cross, but it is underfunded. How do you propose to meet the needs of renters and the undocumented?

What are you going to do to insure Community Development Block Grant funds get to community based non-profit recovery organizations and are used towards long term recovery – and not simply distributed via a recovery authority or through appointed staff at City Hall?

Would you be willing to allocate HMGP (Hazard Mitigation Grant Program) to make a meaningful and sustainable difference to the lives of individual residents? Governments typically use those funds for infrastructure – but some states, like Florida, allocate a portion of those funds to mitigate impact on homeowners and community-based non-profits.

In the future, how do we avoid the Mayor setting-up a recovery fund that cuts off non-profits from their donors and distributes through a closed process managed by government employees with little or no experience in disaster recovery? What can be done to fund the work of community and faith-based non-profit organizations in times of crisis?

Lightening question/ yes or no: After Hurricane Sandy hit, on October 31, 2012, Mayor Bloomberg refused help from the National Guard to assist our brave — but overwhelmed — first responders. If you were in the same position, would you have refused help from the National Guard? [Follow up question: what is one specific thing you would have differently from Mayor Bloomberg to respond to Hurricane Sandy in the first week of the crisis?]

Economy

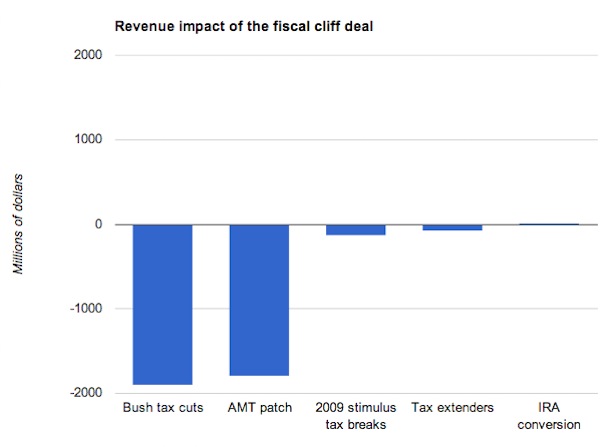

Mayor Bloomberg, like Giuliani and Koch before him, has maintained that continued granting of tax breaks to large corporations is essential if we are to avoid the migration of such businesses from New York to other states and regions. At the same time, we’ve faced cutbacks in various social services amid the very slow and lopsided economic recovery–and the sequester cuts will only increase pressures to reduce costs. What are the implications of these trends for middle class people in New York and what, if anything, do you propose to do differently?

Questions for the Public Advocate

What would you do to make the Public Advocate’s office a budget line item instead of being subject to political whim?

What plans to do have for outreach work, funding, and support for LGBTQ youth experiencing homelessness in NYC?

In light of the Boston Marathon tragedy, how are you going to approach the difficult challenge of “no profiling” and at the same time keeping the public safe?

What will you do to increase the relevance of this vestigial office?

Questions for the Manhattan Borough President

What are your plans for mass transit, like light rail, and enforcing zoning to prevent proliferation of sunlight- and sky-killing skyscrapers?

How would you address the displacement of poor and working class New Yorkers from living in Manhattan?

How are you going to address the difficult problem of union member public employee logging in higher-than-usual hours in the final years of their employ, to bump up their pension payments?

How do you suggest we encourage youth of NYC to take interest in your role?

TWITTER HANDLES OF THOSE WHO VOTED NO*

TWITTER HANDLES OF THOSE WHO VOTED NO*