Congressional Democrats and Republicans have been at loggerheads for weeks over a vote to raise the debt ceiling.* Failure to raise debt ceiling will mean:

- The US currency is no longer the world standard

- We’ll have to pay much higher interest on everything we borrow as a country

- And after a short time juggling the books, government spending for everything will be instantly cut by 44%.

Despite this, the GOP has insisted that any vote to raise the debt ceiling be accompanied by cuts in federal spending of $2 trillion over 10 years and they are adamantly opposed to raising any taxes to increase federal revenues. Yesterday, Obama changed the equation. According to the Washington Post,

Obama and Boehner have emerged as the most enthusiastic proponents of a big deal that would save as much as $4 trillion over the next decade by overhauling the tax code and tackling all the major drivers of federal spending, including the Pentagon and health and retirement programs.

What’s behind the political battle over the debt ceiling? Since most people’s eyes glaze over when the subject is economics, here’s a plain English explanation of the ideas and interests underlying the debt ceiling debate.

Does Deficit Reduction Stimulate the Economy?

1. Would it be safe to say that progressives believe that if the government spends money, the economy will be stimulated and grow, and more people will have jobs?

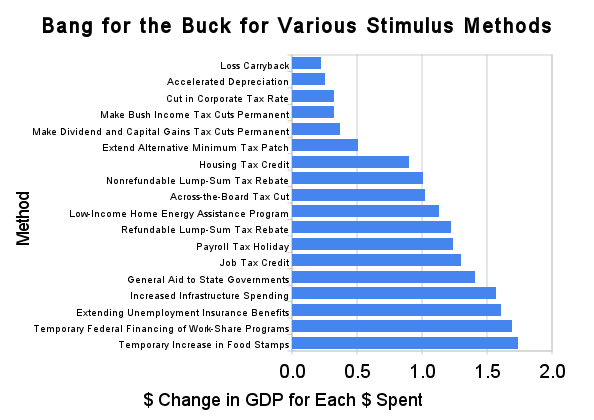

Well, not just that it spends money, but that it does so in targeted ways. According to Mark Zandi, chief economist at Moody’s, the most effective government spending to counteract a recession is food stamps & unemployment insurance. Why? Because people who get that aid need it, so they spend the money right away & it starts circulating through the economy.

Zandi found that the least effective government spending would be on the Bush tax cuts. Why? (i) The Bush tax cuts were never targeted to boost the economy. They were set up, quite literally, to reward Bush’s biggest donors (i.e., fat cats). (ii) Nobody spends money they don’t need to in a recession. Our natural tendency is to hunker down. Do rich people have to spend the money they get in tax cuts? No. Do they? No. Ergo, no additional money circulates through the economy, so it doesn’t grow.

2. Government spends on people, people spend money, other people receive that money, the economy is stimulated. This is good.

2. Government spends on people, people spend money, other people receive that money, the economy is stimulated. This is good.

Basically, yes. In economic terms, government spending in a recession starts the process. The rest of the process you mention is called the multiplier effect.

3. Republicans believe that we have to reduce the deficit by cutting government spending in order to reduce the deficit because we have to reduce the deficit because….you get the point.

Republicans SAY they believe that, but they’re the ones who created 90% of the current deficit, directly or indirectly, in the first place. They held an extension of unemployment insurance hostage over their demand for continuation of the Bush tax cuts at the end of 2010, further deepening the deficit. And they’re now insisting that (a) no taxes be raised to reduce the deficit and (b) any increase in government revenues via elimination of tax loopholes be offset by additional spending cuts. So there’s no reason to take seriously any statements they make about their supposed concern about the deficit. They love deficits. So if they’re not concerned about the deficit, what are their ulterior motives for all the posturing?

Republicans believe several different things that underlie what they say they believe about the economy, all of them wrong:

a. The smaller the government, the greater the individual freedom. Conversely, the bigger the government, the greater the encroachments on individual freedom: This sounds straightforward. In fact, it has deep roots in American culture, having been expressed directly by Thoreau in the early 19th century. More recently, Friedrich Hayek enunciated it when he predicted that the development of Britain’s National Health Service (universal health care to you & me) would turn the UK into another Soviet Union. His prediction obviously was wrong, but that didn’t stop conservatives from continuing to believe it with their typical fervor. There are lots of other problems with this (what measure is used to determine the size of government? i..e, how do we know if a government is too big or too small?), but limits of space & time preclude further elaboration.

b. Tax cuts pay for themselves by increasing economic activity: Reagan tried it with huge tax cuts in 1981. The enormous resulting deficits led him to pass 8 consecutive tax increases (yes, increases), but nobody in the GOP seems to remember that part of the story. Bush, as we know, gave us the closest thing to a pure scientific test of this we’re ever likely to have: With the GOP in control of all 3 branches of government, he passed enormous tax cuts & didn’t subsequently offset them. He had the worst economic growth record of any president since Hoover. Conversely, Clinton raised taxes & had the biggest economic expansion in our country’s history. So much for tax cuts stimulating growth. Again, the evidence has had no influence on GOP thinking.

c. Starve the beast: Grover Norquist famously said he wanted to shrink government to a size that would enable him to “drown it in a bathtub.” Again, see Bush. He cut taxes, waged two wars without paying for them, & passed the Medicare Part D unfunded mandate. Money was drained from the Treasury, but did government shrink? No, it grew. The only president to preside over a shrinkage in the size of government was Clinton, who raised taxes, as previously noted. Again, no correlation backing up the claim, and no acknowledgment of the fact by the GOP.

Lastly, remember who funds their campaigns. The GOP always knows which side their bread is buttered on.

4. Obama believes that we have to reduce the deficit by cutting government spending because ________?

See my answer to #7 below.

5. Obama wants the economy to be stimulated because if more people have more money they will vote for him. Also theoretically he does actually want people to have more money.

One would think…

6. Does Obama think that cutting the deficit is going to stimulate the economy?

I guess he must, but I don’t know.

7. Does deficit reduction stimulate the economy?

For an economy stuck in a severe recession? Hell, no. See #1 above. Just as there’s a multiplier effect, there’s also a negative multiplier effect. Think about it like this: As rain falls on crops, the water circulates into the soil, around the roots of plants, and the plants are fed, enabling them to grow. Imagine what happens when there’s a drought. Water no longer circulates, plants are not fed, and they die.

Right now, not enough money is circulating through the economy–at least, not to ordinary people (the banks have oodles of the stuff–much of it from the bailouts–but they’re not issuing much credit, businesses are not expanding & hiring, unemployed people are not making ends meet, so they’re not spending, so there’s little demand, so businesses aren’t expanding & hiring, rinse & repeat). Since interest rates are near zero, the Fed can’t lower interest rates any more to stimulate the economy. And the consensus in Washington is that we don’t dare–no, no, no–do further stimulus spending to boost the economy. So we’re stuck.

All deficit reduction will do in this context is remove more money from an economy that already has too little circulating through it. Take a look at what’s happening to public service employees. State employees are being laid off right & left. All of them have families, most have houses, cars, bills to pay, etc. but there’s no money to be had. All this is creating enormous strain on state budgets because the demand for Medicaid is going through the roof due to all these people becoming unemployed. So what are the GOP & now Obama talking about? Making enormous cuts to the federal budget (including aid to the states, which is already failing to meet the exploding need). But all the Very Serious People to whom Obama seems to be listening in DC make 6- or 7-figure salaries. None of them know anybody who’s unemployed, I’d venture to guess. Economists have declared the recession over (that’s the recession defined in technical terms, not in terms of what’s actually happening to ordinary people). So I guess Obama thinks that if the technocrats say it’s over, it’s over, & it’s time to start reducing the deficit. Now that I think of it, this brings to mind a recent thread about epistemic closure among conservatives that appeared in blog posts by Henry Farrell, Julian Sanchez & some other smart people. But obviously, conservatives are not the only ones susceptible to that dynamic (of course, reasonable people may disagree about whether Obama is a liberal, a conservative or something else).

* Note: Failure to raise the debt ceiling will affect our ability to meet obligations already made; it has nothing to do with future budgetary decisions that might or might not increase or reduce the deficit.